Key Benefits of Geothermal Tax Credits

- Federal incentives provide thousands of dollars in credits for qualifying geothermal HVAC systems.

- Homeowners typically save approximately $6,000 on installation expenses.

- These credits offset initial costs, enhancing the feasibility of adopting efficient technology.

- Strategic planning and certified installation ensure optimal performance and maximum financial returns.

- Ongoing advantages include decreased utility expenses, minimal maintenance needs, and increased home resale value.

The Importance of Geothermal HVAC Today

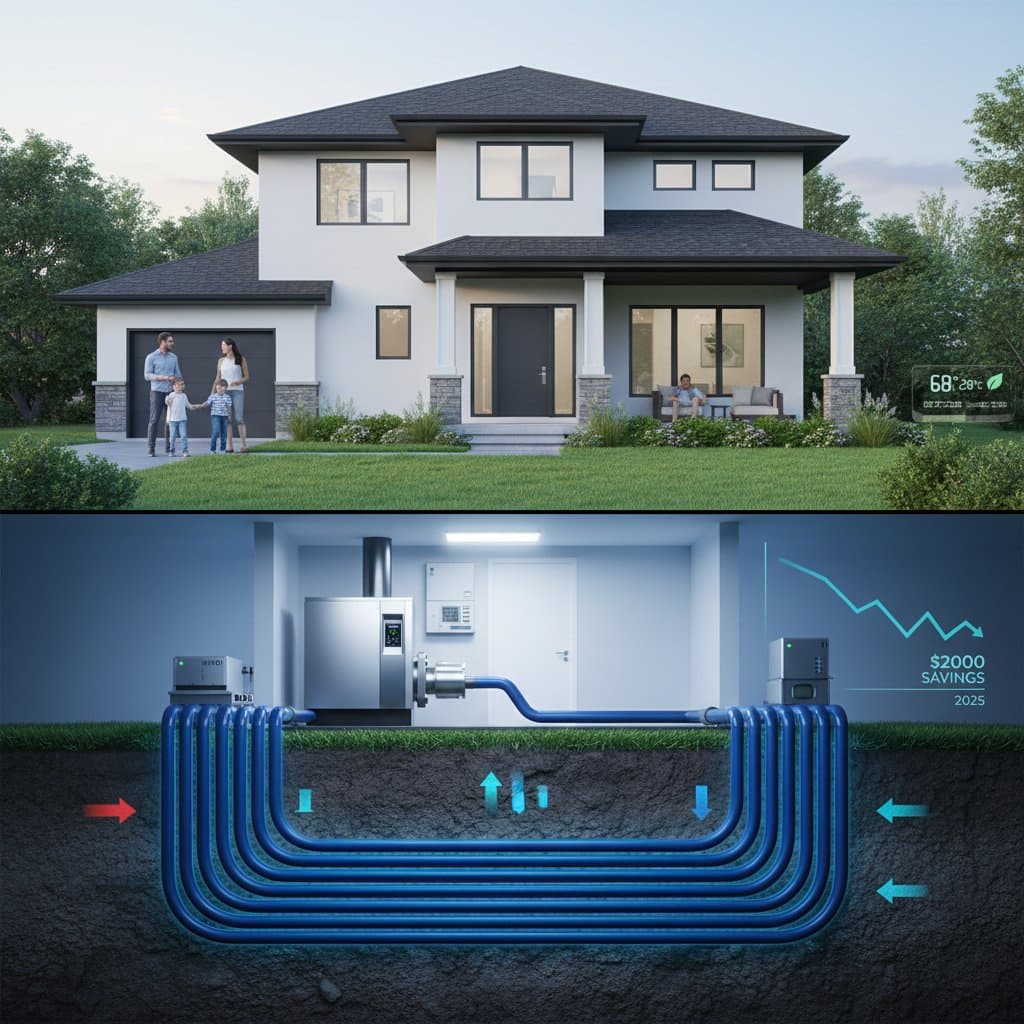

Heating and cooling represent the primary portion of household utility expenses. Conventional systems depend on fossil fuels or variable electricity rates, contributing to elevated costs and carbon emissions. Geothermal HVAC systems, known as ground-source heat pumps, leverage the consistent underground temperatures to provide heating and cooling with superior efficiency.

Installation costs for these systems generally range from $20,000 to $35,000, presenting a notable initial hurdle. Federal tax credits address this challenge by reducing the effective price by about $6,000, which accelerates the return on investment and encourages broader adoption among homeowners.

Understanding the Tax Credit Mechanism

This federal incentive operates as a direct reduction in tax liability, calculated as a percentage of the total installation cost, covering both equipment and labor. For a $25,000 project, the credit amounts to roughly $6,000. Unlike deductions that adjust taxable income, credits apply straight to the taxes owed.

Eligibility requires the system to achieve specific efficiency certifications and installation in a primary or secondary residence. Homeowners need sufficient tax liability to claim the credit, though excess amounts may carry forward to subsequent tax years.

Next Step: Consult your installer and a tax advisor prior to proceeding to verify qualification and optimize your tax position.

Long-Term Financial Advantages

The tax credit serves as an entry point to broader savings. Geothermal systems achieve efficiencies of 300 to 500 percent, delivering three to five units of heating or cooling per unit of electricity used. This efficiency yields utility bill savings of 30 to 70 percent relative to traditional HVAC options.

Integrating the credit with these reductions results in payback periods of seven to twelve years for most installations. Beyond recovery, the system generates ongoing savings over its extended lifespan. With fewer components subject to wear, maintenance demands remain low, further strengthening the economic rationale.

Environmental and Property Value Enhancements

Beyond finances, geothermal technology harnesses renewable earth energy to lower greenhouse gas emissions and lessen reliance on fluctuating fuel supplies. Homes equipped with these systems appeal to eco-conscious buyers, often resulting in quicker sales and premium pricing.

Market analyses indicate that properties featuring energy-efficient upgrades, such as geothermal HVAC, attract higher offers. This positions the investment as both a practical enhancement to daily living and a strategic asset in real estate.

Financing Options Tailored to Homeowners

Large upfront payments challenge many budgets, yet multiple financing avenues exist to facilitate geothermal adoption.

- Home equity loans or lines of credit frequently offer competitive rates for sustainable upgrades.

- Green financing initiatives sometimes integrate repayments into property tax statements.

- Local utility rebates may combine with federal credits for additional cost relief.

Next Step: Obtain detailed quotes from several certified contractors and evaluate financing alternatives to identify the most suitable path forward.

Frequently Asked Questions on Geothermal Incentives

Does homeownership qualify me for the credit?

The incentive applies exclusively to owner-occupied primary or secondary residences.

What occurs if my tax liability falls below the credit amount?

Excess credit can carry forward to future tax years for full utilization.

Steps to Secure Your Geothermal Upgrade

To claim the $6,000 tax credit, align your project timeline with incentive requirements and prioritize compliance. Begin with assessments from certified geothermal specialists, followed by a review of tax implications with an advisor. This approach merges immediate federal support with enduring reductions in energy costs, delivering a home improvement that recoups its value, improves indoor comfort, and appreciates your property's worth.