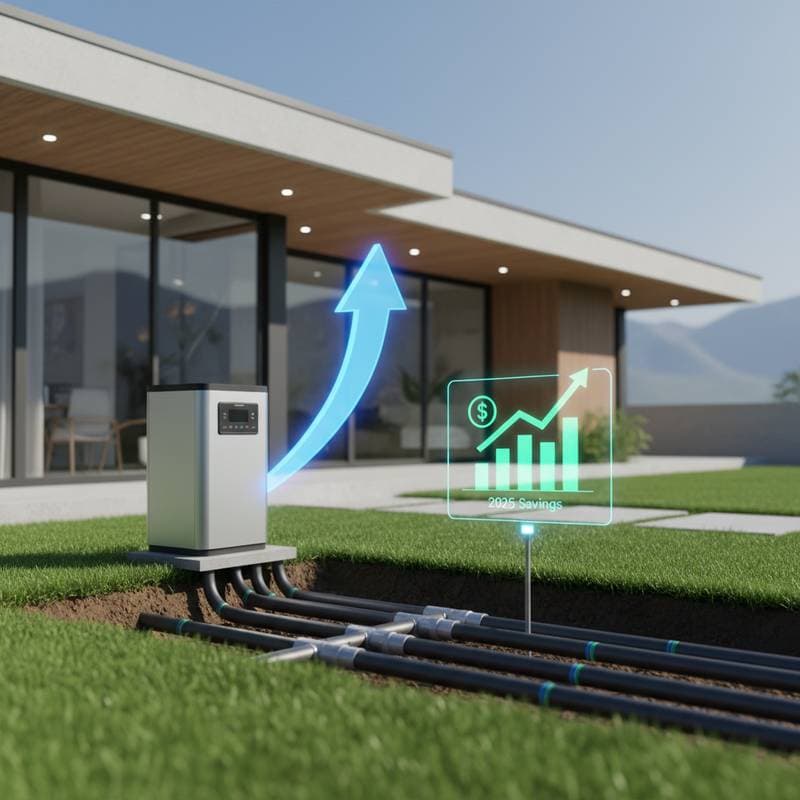

Geothermal Tax Credits Cut System Costs in Half by 2026

Federal tax credits effective in 2026 render geothermal heating and cooling systems highly affordable, with installation costs halved and energy savings reaching 70 percent. Shorter payback periods, reduced maintenance, and significant environmental gains position geothermal to revolutionize residential efficiency and drive clean energy adoption nationwide.