Key Points

- Homeowners can save up to $6,000 through new geothermal tax credits for ground source heat pump installations.

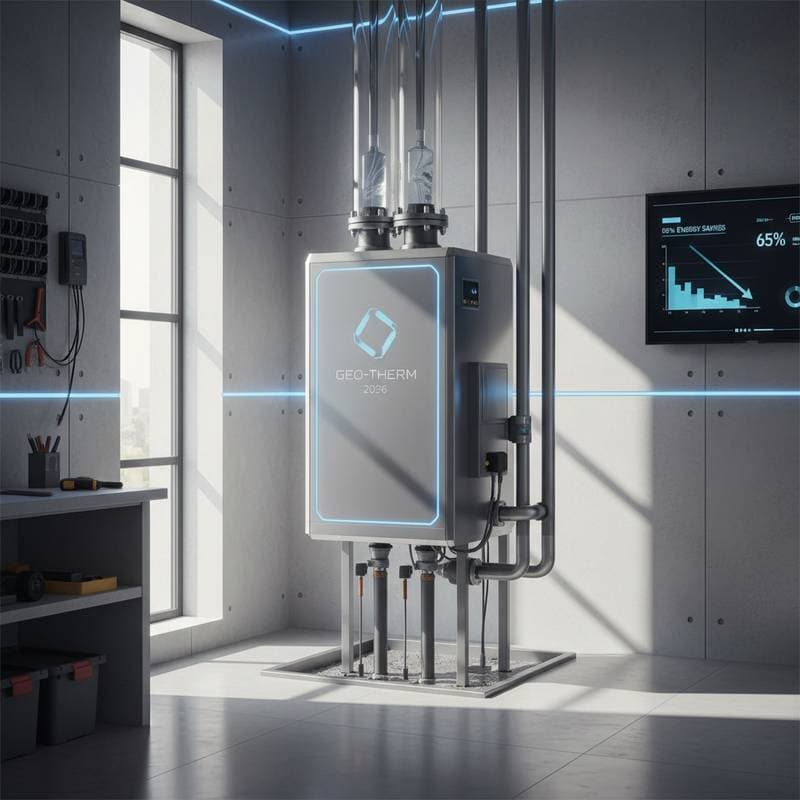

- Geothermal systems cut utility costs by as much as 65 percent compared to traditional HVAC systems.

- Professional installation, proper soil evaluation, and system sizing are crucial for long-term performance.

- Combined rebates and credits can reduce payback periods to as little as five to seven years.

A Fresh Opportunity for Energy Savings

Rising energy bills challenge many homeowners, especially during extreme weather. Geothermal systems offer a reliable solution by harnessing the earth's stable underground temperatures for heating and cooling. New federal tax credits provide up to $6,000 in savings, positioning ground source heat pumps as a practical upgrade for enhanced comfort and reduced environmental impact.

This incentive arrives at an ideal moment for those considering renewable energy options. It supports investments that prioritize efficiency and sustainability over time.

Why Geothermal Systems Are Gaining Momentum

Geothermal heating and cooling systems circulate fluid through underground loops to transfer heat to or from the ground. This process maintains consistent indoor temperatures with minimal energy input, as the earth's subsurface stays at a stable level year-round. As a result, these systems operate more efficiently than conventional furnaces or air conditioners.

Field experience shows that geothermal setups reduce household energy consumption by 25 to 65 percent. They also regulate indoor humidity effectively, delivering balanced comfort. The recent tax credit lowers the entry barrier, aligning upfront costs with substantial ongoing savings.

Understanding the $6K Geothermal Tax Credit

The federal geothermal tax credit covers up to $6,000 for eligible residential ground source heat pump installations. This non-refundable credit applies to equipment and labor costs, provided the system adheres to established energy efficiency standards.

Key details include:

- Eligibility: Systems qualify if installed in a primary or secondary residence and certified as ground source heat pumps.

- Credit Calculation: It equals 30 percent of qualified costs, with a maximum of $6,000 per installation.

- Professional Certification: Installers must hold licenses and ensure compliance with federal and regional efficiency requirements.

- Stackable Benefits: Pair this credit with state rebates or utility incentives to amplify total savings.

Energy analyst Dr. Carla Jenkins notes, "When homeowners combine federal credits with local rebates, the return on investment can be faster than expected, especially in climates with extreme temperature swings."

Expert Tips to Boost Your Home’s Eco-Efficiency

Prepare your property methodically to optimize geothermal performance. Begin with these steps to address potential challenges early.

- Conduct an Energy Audit: Examine insulation levels, window seals, and ductwork for leaks. Addressing these enhances the system's overall effectiveness and accelerates savings.

- Assess Your Site: Evaluate soil composition, lot size, and water table depth. Opt for horizontal loops on expansive properties or vertical ones on compact sites.

- Plan for Electrical Integration: Verify that your electrical panel accommodates the heat pump's demands. Schedule upgrades if current capacity falls short.

- Budget for Quality: Expect installation expenses between $18,000 and $30,000, influenced by system capacity and site specifics. The tax credit offsets a significant share of this outlay.

Select a certified installer experienced in geothermal projects. They perform detailed load calculations to ensure the system matches your home's needs precisely.

Realistic Financial and Environmental Benefits

Initial costs for geothermal systems exceed those of traditional options, yet the advantages justify the investment. Annual utility savings often reach $1,000 to $2,000, varying by location and usage. Incentives shorten the payback to under ten years, yielding years of economical operation thereafter.

On the environmental front, these systems slash greenhouse gas emissions by up to 70 percent relative to gas furnaces. Without combustion, they improve indoor air quality and operate quietly with low maintenance demands. Such features elevate home value and resident well-being.

Meeting Compliance and Certification Standards

Qualifying systems must achieve specific efficiency ratings, typically confirmed via ENERGY STAR certification. Secure local permits and pass inspections to verify safe setup. Retain all contractor documentation for accurate tax filing.

Explore regional renewable energy programs for additional certifications. These can highlight your property's green credentials, appealing to future buyers in eco-conscious markets.

Steps to Secure Your Geothermal Upgrade

Initiate the process with a site assessment from qualified professionals. Obtain detailed proposals from multiple contractors, reviewing designs, timelines, and warranties side by side.

After installation, submit required forms to claim the credit and maintain records of all transactions. This upgrade not only minimizes your environmental footprint but also ensures reliable, weather-independent comfort. Contact certified experts via itsacoolerplanet.com for personalized guidance.

Frequently Asked Questions

Q: How long does a geothermal installation typically take?

A: Most residential projects take two to four weeks from excavation to final hookup, depending on soil conditions and loop design.